Save towards something meaningful. It's always great to start or increase your emergency fund; thinking of going back to school, allocate funds towards that education; it's never to early or too late to consider homeownership; or that well deserved gift - a new car.

Saving with everyone is not the same as saving with like-minded individuals that are goal oriented and determined. Now, you have the liberty to do just that - create your own intimate circle and join other trusted networks that share similar financial goals.

You never know when you're going to need financial aid so the saving process is accelerated. If you need your hand immediately, request with the host to receive the first hand which can be considered a loan because you haven't contributed to a full term. Unlike a person that is not looking forward to their hand, accept the last hand and you can truly say, I saved!

There are two types of Sue Sue you can participate in:

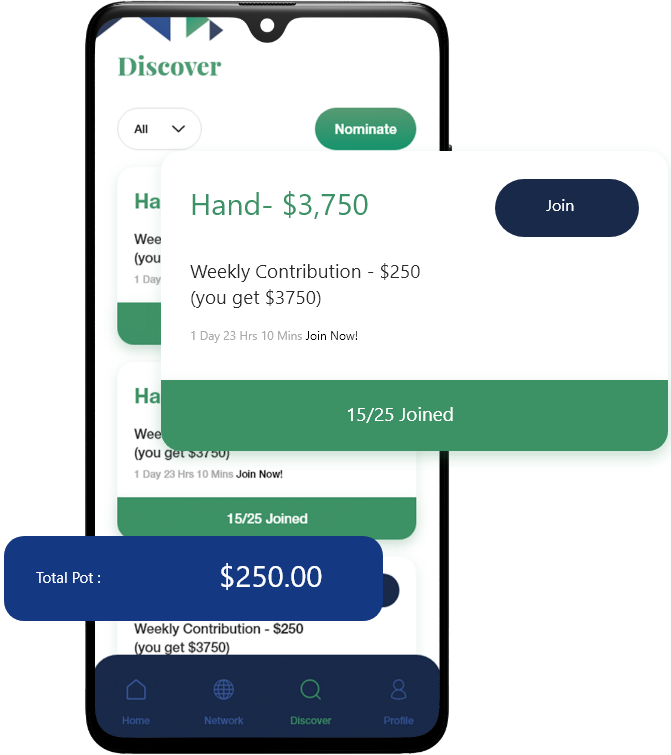

A private Sue Sue is hosted by an individual that invites their desired members by an invitation only request.

A public Sue Sue is hosted by Sue Sue App and allows all users to join any open Sue Sues based on their saving goal.

Gather your close friends and family members and save towards a common or specific goal.

Access the mobile application from Apple App Store or Google Play. Follow the instructions to create an account. Then, create a Sue Sue for whatever purpose you want.

Build a strong network of savers that are committed. You can encourage up to 26 individuals to join your Sue Sue. Invite the people you trust from your phone contacts or share an invitation code which let's them know, we're on a mission to save big. Now, wait for everyone to connect!

It's official, your Sue Sue is active. You can create up to three Sue Sues with different purposes and expand your saving network with other like-minded individuals.